If you’re new to money management, these step-by-step budgeting tips for beginners in the U.S., including an easy U.S. monthly budget for beginners 2025 and a beginner budget plan USA 2025, will get you started without confusion. In a few minutes you’ll learn practical, low-stress steps to track every dollar, build an emergency fund, and trim costs while still enjoying life.

Why Budgeting Matters for Everyday Americans

Most households in the U.S. feel money pressure at some point: rising grocery bills, healthcare costs, rent increases, and surprise car repairs can quickly drain savings. A simple budget doesn’t have to be strict — it should give you clarity and control. When your dollars have jobs, you stop wondering where your money went and start steering toward meaningful goals: paying off debt, saving for a house, travel, or just calmer finances.

Step 1 — Start with Your Why

Before you track numbers, define your purpose. Specific goals make tradeoffs easier.

-

Goal example A: Save $1,000 emergency fund in 90 days.

-

Goal example B: Pay down $6,000 credit card debt by Dec 2026.

-

Goal example C: Save $5,000 for a down payment by 2028.

Example: Jane, 27, in Denver, wanted to save $2,000 for a used car in one year. She identified subscription leaks and added a weekend freelance shift. Framing the goal as “car fund” motivated small, consistent choices.

Step 2 — Track Every Dollar (Practical How-To)

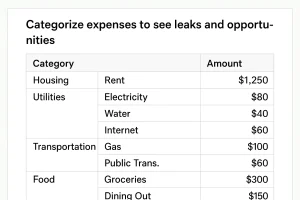

Gather bank and credit card statements for the last three months. Record every income source (after taxes) and categorize every expense. Seeing recurring charges is the quickest way to find savings.

Step-by-step tracking

-

Export or screenshot three months of transactions.

-

Highlight fixed costs (rent, loan payments) and variable costs (groceries, gas).

-

Look for hidden subscriptions and small recurring charges.

-

Total each category and compute a monthly average.

Tools to speed this up: Mint, YNAB, EveryDollar, Simplifi, or a clean Google Sheets template.

Example snapshot

-

Monthly income (after tax): $3,800

-

Rent: $1,100

-

Utilities: $180

-

Groceries: $450

-

Transportation: $300

-

Insurance (health + car): $250

-

Subscriptions: $70

-

Dining out: $200

-

Savings: $0

Insight: If “savings” is zero, your budget is reactive. Move $50–$200 per month to savings automatically to start.

Step 3 — Pick a Budgeting Method That Matches Your Personality

Not every system works for every person. Choose the one you’ll actually use.

50/30/20 Rule

-

50% Needs: rent, groceries, utilities, minimum debt payments.

-

30% Wants: entertainment, dining, hobbies.

-

20% Savings/Debt repayment.

Why it works: Simple, flexible, and forgiving for beginners.

Zero-Based Budgeting

-

Assign every dollar a job until income minus expenses = $0.

Why it works: Great control and accountability. Best for variable income or aggressive savers.

Envelope System (Digital or Cash)

-

Allocate fixed amounts to categories (groceries, gas) and stick to them.

Why it works: Prevents overspending in tempting categories.

Practical tip: Try 50/30/20 for one month, then move to zero-based if you want more precision.

Step 4 — Build a Starter Emergency Fund (with timelines)

A buffer is your financial shock absorber.

-

Starter target: $1,000 in 30–90 days.

-

Medium-term target: 3 months of essential expenses.

-

Long-term: 6 months if you have dependents or unstable income.

How to save $1,000 in 10 weeks

-

Save $100/week: cut one dining-out night ($40), cancel a $15 subscription, and sell unused items for $45.

Case Study — The Ramirez Family

The Ramirez family in Ohio earned $60,000/year but were living paycheck-to-paycheck. They tracked spending, cut $250/month in takeout and $120/month in subscriptions, and redirected that $370 to savings. After 12 months they had paid down $8,000 in credit card debt and built a $4,500 emergency fund.

Step 5 — Reduce Expenses Intentionally (Practical Moves)

Small, repeatable decisions add up.

Grocery savings

-

Plan meals and shop with a list.

-

Use store loyalty programs and digital coupons.

-

Swap name brands for store brands on staples (milk, pasta, canned goods).

Estimated savings: $50–$150/month.

Utilities and bills

-

Lower thermostat a degree or two.

-

Compare internet plans yearly and negotiate.

-

Unbundle services only if cheaper.

Transportation

-

Combine errands into one trip to save gas.

-

Shop car insurance annually and compare quotes.

Tech and subscriptions

-

Audit monthly subscriptions and pause or cancel those unused.

Use a password manager and keep a list of active services to make audits simpler.

Step 6 — Automate Savings and Bill Payments

Automation is the lazy-person’s budgeting superpower.

Set up these automations

-

Round-up savings apps: Acorns, Chime Save the Change.

-

Auto-transfer to a high-yield savings account each payday.

-

Auto-pay credit card at least the minimum to avoid interest.

Banking tip: Use an FDIC-insured online bank for higher APY on savings (rates vary; check current offers in 2025).

Example automation setup

-

Payday: $300 to Emergency Savings.

-

Monthly: $25 to Vacation Fund, $50 to Car Maintenance Fund.

- Bills: Auto-pay utilities and insurance.

Step 7 — Create “Sinking Funds” for Irregular Costs

Save a little each month for items that don’t recur monthly—holiday gifts, annual insurance, home repairs.

How it works

-

Estimate cost and divide by months until due.

-

Open a separate savings account or sub-account to avoid temptation.

Example: Annual car registration $240 → save $20/month.

Case Study — Marcus from Texas

Marcus had a $1,200 repair every two years. He began saving $50/month into a labeled “Car Repair” account. When repairs arrived, he paid cash and avoided high-interest credit cards.

Step 8 — Use the Right Debt Repayment Strategy

Paying debt efficiently frees monthly cash flow.

Debt Snowball (Behavioral)

-

Pay the smallest balance first for quick wins and momentum.

Debt Avalanche (Mathematical)

-

Pay the highest interest rate debt first to minimize total interest.

Example comparison

-

Card A: $1,200 at 22% APR.

-

Card B: $6,000 at 8% APR.

Avalanche: target Card A first to reduce interest. Snowball: pay Card A first if it motivates you.

Step 9 — Monitor Progress and Adjust Monthly

Make a 20-minute monthly ritual:

-

Reconcile accounts.

-

Check savings balances.

-

Reassign extra cash to the most important goal.

-

Check for new subscriptions or price changes.

Tracking KPI examples

-

Savings rate (% of net income saved).

-

Debt reduction month-to-month.

-

Net worth (assets minus liabilities).

Step 10 — Increase Income Strategically (If Needed)

If expenses are tight, consider income boosts:

Side gig ideas & realistic ranges

-

Freelance writing/design: $200–$1,000+/month.

-

Part-time delivery/rideshare: $150–$600/month part-time.

-

Sell unused items online: one-time $50–$500 boosts.

Tip: Use extra income to accelerate savings and debt payoff, not to inflate lifestyle.

Real-Life Case Study — Single Parent, New Start

Aisha, a single parent in Atlanta, worked evenings as a virtual assistant for three months while streamlining her grocery budget. Extra income paid for childcare briefly and allowed her to save $2,500 in six months for a security deposit on a new apartment.

Recommended Articles (reader-focused suggestions)

-

Emergency Fund 101: How Much Should You Save?

-

Best Affordable Health Insurance Plans for Families (2025)

-

Free Apps That Make Everyday Life Easier (2025)

-

10 Cheap & Healthy Meals to Cook at Home (2025 Edition)

Tools and Templates to Use Right Now

-

30-day budget jumpstart worksheet (downloadable template idea).

-

Google Sheets month-by-month budget template.

-

Grocery shopping list template and $5 meal plan.

Common Budgeting Mistakes and How to Fix Them

-

Ignoring irregular costs → create sinking funds.

-

Being overly strict and burning out → add “fun money.”

-

Not automating → schedule transfers.

-

Ignoring insurance and healthcare → estimate premiums and copays.

Advanced Moves (When You’re Ready)

-

Refinance high-interest loans.

-

Consolidate small debts (carefully, understand fees).

-

Invest small amounts tax-advantaged: check your 401(k) employer match first.

FAQ — Budgeting Questions Beginners Ask

Q1: How much should a beginner save each month?

Start with 5–10% if cash is tight; work toward 15–20% as you optimize.

Q2: Should I pay off debt or save first?

Build a starter emergency fund ($1,000), then prioritize high-interest debt. Later split funds between saving and extra payments.

Q3: What if I have irregular income?

Use a 6–12 month average to set a baseline and prioritize essentials. Stash extra income for lean months.

Q4: How do I budget with kids?

Track child-related costs and include them as needs; explore family health insurance options and tax credits for eligible households.

Q5: Which apps are safest to use?

Choose reputable apps with strong reviews and two-factor authentication; check for bank-level encryption and FDIC-insured partners.

Q6: Can budgeting help me buy a house?

Yes—budgeting improves credit, lowers debt-to-income ratio, and helps you save for a down payment.

Q7: How long to build a 3-month emergency fund?

If you save $300/month and need $6,000, expect about 20 months. Speed up by trimming expenses or adding income.

Q8: Are cash envelopes still useful?

Yes—many people find physical or digital envelopes enforce discipline for discretionary spending.

Q9: How to handle windfalls and bonuses?

Rule of thirds: 50% to debt/savings, 30% long-term goals, 20% for a one-time enjoyable purchase.

Q10: What’s the best way to track subscriptions?

Create a running list, use a spreadsheet, and review quarterly to cancel unused services.

30-Day Budget Jumpstart (Action Plan)

Week 1 — Build the Base (Days 1–7)

Day 1: Gather statements and open a Google Sheet or app.

Day 2: List income and calculate take-home pay.

Day 3: Categorize expenses.

Day 4: Identify three quick wins (cancel one subscription, cook at home twice, compare insurance).

Day 7: Review progress and celebrate a small win.

Week 2 — Trim and Test (Days 8–14)

Day 8: Create a one-week meal plan.

Day 9: Compare insurance and internet prices.

Day 10: Pause an unused subscription.

Day 14: Reconcile the week and move savings to a labeled account.

Week 3 — Automate and Allocate (Days 15–21)

Day 15: Set up auto transfers for savings on payday.

Day 16: Create sinking funds for three irregular costs.

Day 17: Check retirement contributions and employer match.

Day 21: Celebrate progress.

Week 4 — Review and Scale (Days 22–30)

Day 22: Find one more place to save $25–$50/month.

Day 25: Plan next month’s irregular expenses.

Day 30: Set new goals and continue momentum.

Sample Monthly Budget for $3,500 Net Income (Text Table)

-

Housing (rent/mortgage): $1,050 (30%)

-

Utilities & Internet: $175 (5%)

-

Groceries: $350 (10%)

-

Transportation (gas, insurance): $315 (9%)

-

Insurance (health, car): $175 (5%)

-

Debt payments (minimums + extra): $350 (10%)

-

Savings: $350 (10%)

-

Retirement (401(k)/IRA): $175 (5%)

-

Subscriptions & Entertainment: $140 (4%)

-

Misc/Buffer: $170 (5%)

Explanation: This sample assigns 30% to housing which varies by region. Adjust percentages based on local costs and priorities.

How to Handle Windfalls

When a refund, bonus, or gift arrives:

-

50% to debt reduction or savings.

-

30% to long-term goals or investments.

-

20% for a one-time treat.

Final Thoughts

Budgeting is a learned skill, not an innate talent. Start with one paycheck: track it, assign jobs to your dollars, and automate a small transfer to savings. Try one method for 30 days and adjust. If you want weekly, bite-sized tips, templates, and budget-friendly recipes delivered to your inbox, subscribe to our newsletter. Start today — your future self will thank you.

Recommended reading

-

The Reset Toolbox: Practical Money Strategies That Actually Work.

-

Cash Flow Clarity: Mastering Your Money’s True Story.

-

Stress Management Hacks for Busy Americans.